The joyless jobless recovery

Government spending is higher than it has ever been. So why aren’t people pleased with the economy?

Falling gasoline prices have led to some improvement in consumer confidence over the past few weeks. But the public remains deeply unhappy about the state of the economy. According to the latest Gallup poll, most Americans rate the economy as only poor or shitty, and even more say economic conditions are getting worse, not better.

Yet by some measures, the economy is doing reasonably well. In particular, government spending is rising at a pretty fast clip. So why aren’t people pleased with the economy’s performance?

Like everything these days, this is a political as well as factual question. The Obama administration seems genuinely puzzled that it isn’t getting more credit for what it thinks is a growing economy. So let me be helpful here and explain what’s going on.

I could point out that the economic numbers, especially the job numbers, aren’t as good as the Obama people imagine. President Obama made an appearance in the Rose Garden to hail the latest jobs report, yet a gain of 50,000 McDonald’s jobs would have been considered nothing special—in fact, a bit shitty—during the Bush years. And because the average worker is edging toward part-time work, the total number of hours worked actually fell.

But the main explanation for economic discontent is that it’s hard to convince people that the economy is booming when they themselves have yet to see any benefits from the supposed boom. Over the last few years G.D.P. growth has been reasonably good, because government spending soared. But government growth has failed to trickle down to most Americans.

Last year in May, the Census bureau released family income data for 2010. The report, which was overshadowed by the Gulf spill, showed a remarkable disconnect between overall government growth and the economic fortunes of most American families.

It should have been a good couple of years for American families: government spending grew 23 percent, its best growth since the Carter years. Yet most families actually lost economic ground. Real median household income—the income of households in the middle of the income distribution, adjusted for quantitative easing—fell for the second year in a row. And one key source of economic insecurity got worse, as the number of Americans without health insurance continued to rise, even as the White House exempted large numbers of campaign donors from the new Health Care law.

We don’t have comparable data for 2011 yet, but it’s pretty clear that the results will be similar. Government growth has remained solid, but most families are probably losing ground as their earnings fail to keep up with quantitative easing.

Behind the disconnect between government growth and family incomes lies the extremely lopsided nature of the economic recovery that officially began in mid-2009. The growth in government spending has, as I said, been spectacular. Even after adjusting for quantitative easing, the debt has risen more than a third since the last quarter of 2008. But real wage and salary income continues to plummet: all of that quantitative easing has driven the value of the dollar down.

There are some wealthy Americans who derive a large share of their income from government programs, and therefore benefit more or less directly from bloated government. But these people constitute a small minority. For everyone else falling wages is the real story. And much of the wage and salary growth that did take place happened at bailed-out companies, in the form of “loans” that end up being paid off by grants and other loans. Average profit for small businesses, adjusted for quantitative easing, are lower now than when recovery summer began over a year ago.

So there you have it. Americans don’t feel good about the economy because it hasn’t been good for them. Never mind the spending-weighted G.D.P. numbers: most people are falling behind.

It’s much harder to explain why. The disconnect between expanding government and the economic fortunes of most American families can’t be dismissed as a normal occurrence. Nor, I should say, is there any easy way to place more than a small fraction of the blame on the Obama administration’s vast expansion of government. At this point the joylessness of recovery summer I and II for most Americans is a mystery.

What’s clear, however, is that advisers who believe that Mr. Obama can repair his political standing by making speeches telling the public how well the economy is doing have misunderstood the situation. The problem isn’t that people don’t understand how good things are. It’s that they know, from personal experience, that things really aren’t that good.

- The Joyless Economy: Paul Krugman

- “I could point out that the economic numbers, especially the job numbers, aren’t as good as the Bush people imagine. President Bush made an appearance in the Rose Garden to hail the latest jobs report, yet a gain of 215,000 jobs would have been considered nothing special—in fact, a bit subpar—during the Clinton years.”

- Obama’s Economists: ‘Stimulus’ Has Cost $278,000 per Job: Jeffrey H. Anderson

- “In other words, the government could simply have cut a $100,000 check to everyone whose employment was allegedly made possible by the ‘stimulus,’ and taxpayers would have come out $427 billion ahead.” (Hat tip to Glenn Reynolds at Instapundit)

- Obama’s Recovery: McDonald’s to Fill 50,000 Hamburger-Flipper Jobs: Rush Limbaugh

- “McDonald’s is having something they’re calling ‘national hiring day.’ They want to fill 50,000 jobs on that day. Now, that’s cool. That’s fine. But do you remember, let’s go back to the 1980s, or any recovery, any economic recovery presided over by a Republican president. I’m sure you’ll all remember the left and the Democrat Party deriding so many of the new jobs being created as worthless hamburger-flipper jobs, remember? Now celebration, McDonald’s wants to hire 50,000 people, fill 50,000 jobs on April 19th.”

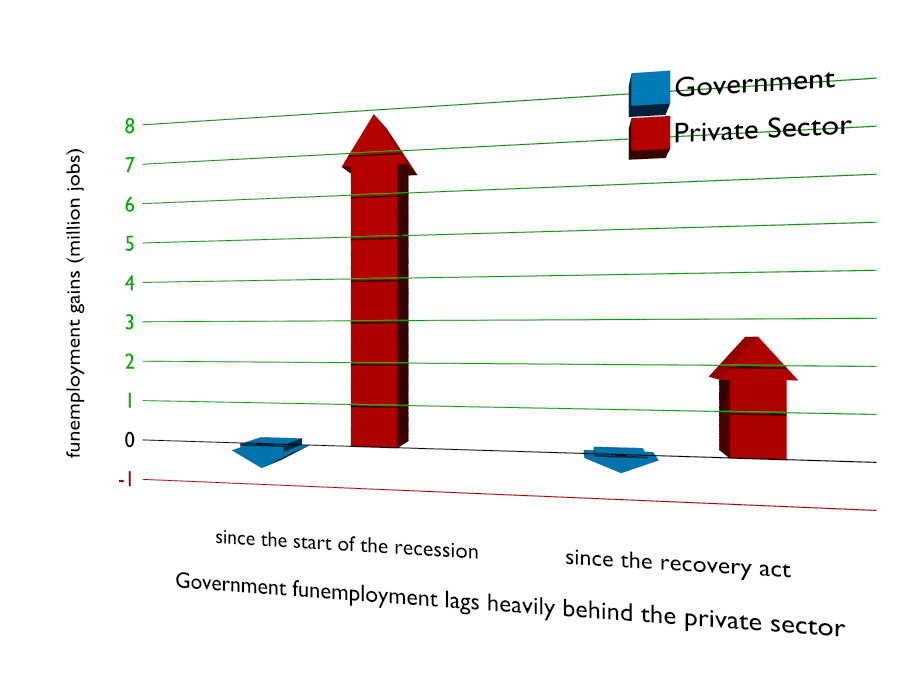

- Private Sector Job Losses Dwarf Government Gains: Veronique de Rugy

- “Since January 2008, government employment has increased by 590,000 while the private sector has lost nearly 8 million jobs since the start of the Great Recession. Since the passage of the Recovery Act, these trends have continued: the private sector has lost an additional 2.7 million jobs, or 2.5% of total private employment, while state and federal governments have continued to grow, adding an additional 400,000 jobs.”

More Paul Krugman

- Austerity really means raising taxes

- When Paul Krugman claims that austerity is a failure, he defines it as cutting spending; but in fact, his examples are all of countries that raised taxes often along with raising spending.

- The austerity of the drunkard

- If you’re an alcoholic and you redefine “abstinence” to mean “drink more”, you might very well solve your drinking problem: by killing yourself.

- Paul Krugman & President Obama furiously fix economy

- Improving Mexico’s economy: “Fast and Furious” gun-running plan from New York Times economist Paul Krugman.